ridinglawnmower.site Gainers & Losers

Gainers & Losers

How Much To Install Sauna In House

Depending on the size of the sauna and how powerful the sauna heater is, the annual cost of maintaining a home sauna may range widely. installation nationwide. Frequently asked questions here FAQS Price, low to high. Price, high to low. Date, old to new. Date, new. Traditional saunas range from $6, to $11,+ depending on size and payment method. Infrared saunas range from $4, to $9,+. Sauna Financing: Please. Our DIY sauna liner kit is the easiest way to have a complete sauna quickly installed in your home or commercial space. Pros of an Indoor Sauna. There are many pros to owning an electric heater. An electric heater is easy to install and maintain. You don't have to worry. installation nationwide. Frequently asked questions here FAQS Price, low to high. Price, high to low. Date, old to new. Date, new. In contrast, traditional steam saunas cost between $20 and $month to run. An idle sauna doesn't cost ridinglawnmower.siteed saunas usually cost less to run than. Capacity: 4 people. Red Knotty or Clear Cedar. Electric heater. From: $2, Build price. 5 FEET Cedar Sauna Kits. 5x5x7 Custom Indoor Cedar Sauna Kit. The costs range from $2, to $12, Less expensive infrared saunas may emit harmful gases from the wood during the heating process. Be aware that there are. Depending on the size of the sauna and how powerful the sauna heater is, the annual cost of maintaining a home sauna may range widely. installation nationwide. Frequently asked questions here FAQS Price, low to high. Price, high to low. Date, old to new. Date, new. Traditional saunas range from $6, to $11,+ depending on size and payment method. Infrared saunas range from $4, to $9,+. Sauna Financing: Please. Our DIY sauna liner kit is the easiest way to have a complete sauna quickly installed in your home or commercial space. Pros of an Indoor Sauna. There are many pros to owning an electric heater. An electric heater is easy to install and maintain. You don't have to worry. installation nationwide. Frequently asked questions here FAQS Price, low to high. Price, high to low. Date, old to new. Date, new. In contrast, traditional steam saunas cost between $20 and $month to run. An idle sauna doesn't cost ridinglawnmower.siteed saunas usually cost less to run than. Capacity: 4 people. Red Knotty or Clear Cedar. Electric heater. From: $2, Build price. 5 FEET Cedar Sauna Kits. 5x5x7 Custom Indoor Cedar Sauna Kit. The costs range from $2, to $12, Less expensive infrared saunas may emit harmful gases from the wood during the heating process. Be aware that there are.

Home>Three Person Far Infrared Indoor Sauna. Skip to the end of the images sauna, a home sauna. Add to Wish List Add to Compare. Features. Features. The energy efficiency of our saunas means that running costs are very low: only about cents per 40 minute session. Deluxe Home Sauna Kit with Apollo Sauna Heater & Control system. x x mm. SIK/DDA. Regular Price: £3, Many four-person saunas cost less than $4, Installation typically costs about $1,, although prices can vary depending quite a bit depending on your area. An indoor sauna installation has an average cost of $4, But some models can go as low as $3, or as high as $6, The price would typically depend on. Discover the possibilities of installing a sauna at home! Learn about costs, benefits, and tips for a perfect home sauna experience in this detailed blog. Handcrafted for your in-home installation · Custom sauna design · How it works · Designing and building your sauna · Interior design · Backrest designs · Heater. How Much Do Infrared Saunas Cost? Many Good Health Saunas® range between $k. As with any purchase, you'll get what you pay for. At GHS®, we're proud to. Certainly, installing a sauna upstairs in your home is entirely feasible. Modern pre-built saunas are specifically designed to be lightweight, making them ideal. Freestanding Indoor Sauna · High Quality Pre-fab Indoor Saunas · NOW AVAILABLE · Made From High Quality Solid Wood! · $ · DIY Sauna Kits are also available. Some infrared saunas can be set up on carpeted floors. Check the manufacturer's guidelines for specific information. Most saunas are at least seven feet tall. How Much Does Saunas Cost to Install? · Around $6, and more for barrel saunas · From $7, for a small DIY sauna · About $10, (or more!) for a custom-built. Regular price $2, Sale price $4, · Finnish Sauna Builders sauna installation team will white glove the delivery, set-up, and installation of your new. Almost Heaven Himalaya 4-Person Indoor Sauna $10, Original price was: $10, $7, Current price is: $7, Indoor saunas are a bit different. You can get a pre-cut sauna for your home for around $2, cut exactly to your specifications, making installation much. Indoor saunas can be created by converting a storage closet or small bathroom. As long as you have access to a volt service for your heater or infrared. Prices start at around $2, for an entry level unit, $7, to $10, for high-quality, mid-market saunas and $10,+ for premium, custom built models. Easy to install far infrared sauna for home spa. Carbon heated hemlock wood with glass door. Bluetooth loudspeaker and time temperature LED control panel. $2, to $3, In the $2, to $3, price range, customers can expect high-end saunas with premium features. These saunas often come with advanced control. The total cost for a professionally installed two-person steam shower will be about $3, A custom steam room will cost much more, from $2, to $8,

Student Loan Interest Deduction Income Limit

The student loan interest deduction is generally the smaller of $2, or the interest paid that year on a qualified student loan. This amount is gradually. There are also limits to your adjusted gross income which may influence the amount of a deduction you may take. The amount of your deduction will be gradually. The maximum student loan interest deduction is $2,, but is phased out or reduced out if the taxpayer's modified adjusted gross income (MAGI) is between. The deduction cap has been $ since , Tuition and room and board at that time at a private elite college was $30, Tuition and room. Your modified, adjusted gross income (MAGI) is not more than $90, if filing as single, head of household, or qualifying widow(er) or not more than $, Eligible students have adjusted gross earnings of no more than $90, and receive the full credit if their modified adjusted gross income is $80, or less. The maximum deduction is $2, per year. The loan proceeds must have been used to pay for the qualified higher education expenses (tuition and fees required. The amount of your student loan interest deduction is phased out if your modified adjusted gross income (MAGI) is between $50, and $65, ($, and. $, if married filing jointly. The deduction is completed phased out if your AGI is: File with H&R Block to get your max refund. The student loan interest deduction is generally the smaller of $2, or the interest paid that year on a qualified student loan. This amount is gradually. There are also limits to your adjusted gross income which may influence the amount of a deduction you may take. The amount of your deduction will be gradually. The maximum student loan interest deduction is $2,, but is phased out or reduced out if the taxpayer's modified adjusted gross income (MAGI) is between. The deduction cap has been $ since , Tuition and room and board at that time at a private elite college was $30, Tuition and room. Your modified, adjusted gross income (MAGI) is not more than $90, if filing as single, head of household, or qualifying widow(er) or not more than $, Eligible students have adjusted gross earnings of no more than $90, and receive the full credit if their modified adjusted gross income is $80, or less. The maximum deduction is $2, per year. The loan proceeds must have been used to pay for the qualified higher education expenses (tuition and fees required. The amount of your student loan interest deduction is phased out if your modified adjusted gross income (MAGI) is between $50, and $65, ($, and. $, if married filing jointly. The deduction is completed phased out if your AGI is: File with H&R Block to get your max refund.

This bill modifies the tax deduction for student loan interest to (1) increase limitation on the deduction based upon modified adjusted gross income. The June 17, , amendments added a coauthor, modified the operative date, specified when the limitation on the deduction for interest on education loans. Married taxpayers filing jointly: If both spouses are qualified individuals, both may claim the credit based on their earned income and eligible education loan. Modified adjusted gross income (MAGI) limits. For , the amount of your student loan interest deduction is gradually reduced (phased out) if your MAGI is. $80, if filing single, head of household, or qualifying widow(er); $, if married filing jointly. The deduction is completed phased out if. The maximum amount of student loan interest you can deduct each year is $2, The deduction is phased out if your adjusted gross income (AGI) exceeds certain. Tax expenditure data for undefined under Personal Income Tax - Deductions from Adjusted Gross Income limitation raised taxpayer income limitations through the. There are also limits to your adjusted gross income which may influence the amount of a deduction you may take. The amount of your deduction will be gradually. The program has a lifetime credit cap of $25, The Student Loan Repayment Tax Credit Worksheet to claim this tax credit for the tax year is now. To be eligible, individual filers with modified adjusted gross income (MAGI) below $80, and couples filing jointly with incomes of less than $, The. What are the income limits for eligibility? · If you are a single filer, the phase out begins at $75, You can't claim the deduction, if your MAGI is $90, You may be eligible to deduct a portion of the interest paid on your federal tax return. This is known as a student loan interest deduction. The max deduction is $2, for your tax return. This max is per return, not per taxpayer, even if both spouses on a joint return qualify for the deduction. The Student Loan Interest deduction is taken in the "adjustments to income The maximum deduction amount that can be claimed is $2, per taxpayer. You can deduct up to $ in student loan interest per year. This even applies to interest on personal loans used for educational purposes. Learn more! The Federal student loan interest deduction is limited to $2, and is available to single filers with AGIs of $70, and under, and to joint filers with AGIs. Assuming you meet all the requirements to receive the student loan interest tax deduction, you can deduct up to $2, in qualifying interest payments within. Your modified adjusted gross income must be $75, or less if single and $, or less if married and filing together. You may not claim this deduction if. The maximum amount of deductible interest is $2, for You can fully deduct your student loan interest (up to $2,) if you meet the following. No, you don't pay taxes on the amount of money you owe for student loans. You may be able to apply for tax relief because of student loans, though, and any.

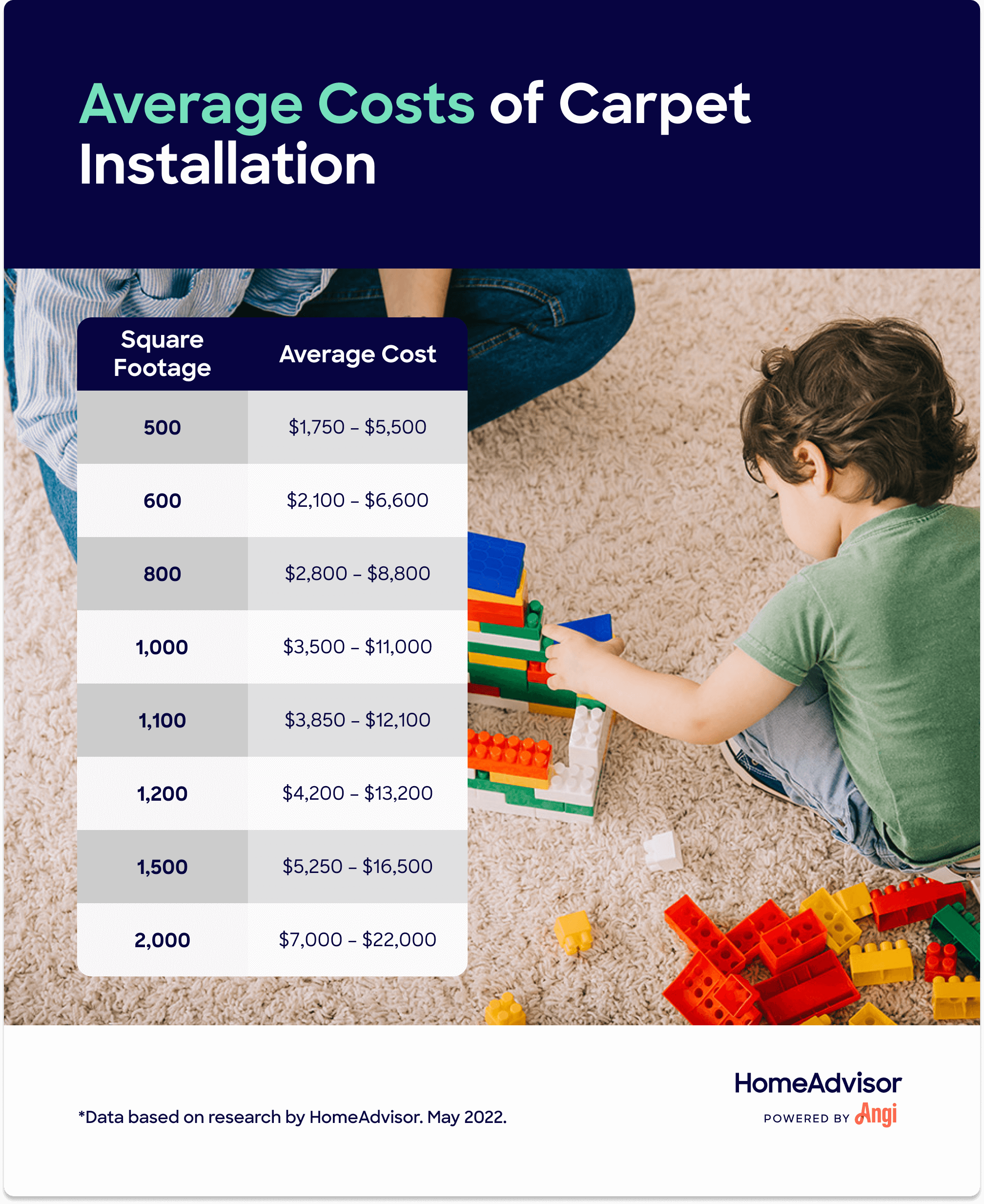

Average Cost For Carpet Per Square Foot

Most homeowners pay between $7 and $12 per square foot for both carpet and installation, for a total of perhaps $ to $ to carpet most rooms in the home. The average carpet installation cost is $2 - $9 per sq ft. · Room-specific costs vary: bedrooms ($1, to $6,), living rooms ($1, to $7,), basements ($. I PAY per sqyd for the cheapest carpet and my labor COST is a sqft. Carpet goes up in quality at 12 per square yard, then level up. Carpet is priced and sold by the square foot or square yard. Covering square feet is less then covering square feet. The difference between $ a. Take my Carpet Foot-Traffic Test to learn your Foot Traffic Score. $ cents per square foot is the same price as $ per square yard. The. Most carpet comes in a standard width of 12 feet. With this being the case, if you have a room that measures only 8 feet wide by 8 feet long, the raw square. Totals - Cost To Install Carpet, SF, $1,, $1, ; Average Cost per Square Foot, $, $ Whether you're curious about the costs associated with engineered wood, carpet Material costs encompass the price per square foot of the flooring material. The cost of carpet installation ranges from $ to $ per square foot, on average, for labor and materials. Cost per square foot. Urethane foam. Most homeowners pay between $7 and $12 per square foot for both carpet and installation, for a total of perhaps $ to $ to carpet most rooms in the home. The average carpet installation cost is $2 - $9 per sq ft. · Room-specific costs vary: bedrooms ($1, to $6,), living rooms ($1, to $7,), basements ($. I PAY per sqyd for the cheapest carpet and my labor COST is a sqft. Carpet goes up in quality at 12 per square yard, then level up. Carpet is priced and sold by the square foot or square yard. Covering square feet is less then covering square feet. The difference between $ a. Take my Carpet Foot-Traffic Test to learn your Foot Traffic Score. $ cents per square foot is the same price as $ per square yard. The. Most carpet comes in a standard width of 12 feet. With this being the case, if you have a room that measures only 8 feet wide by 8 feet long, the raw square. Totals - Cost To Install Carpet, SF, $1,, $1, ; Average Cost per Square Foot, $, $ Whether you're curious about the costs associated with engineered wood, carpet Material costs encompass the price per square foot of the flooring material. The cost of carpet installation ranges from $ to $ per square foot, on average, for labor and materials. Cost per square foot. Urethane foam.

So sq ft probably. Prices are a different issue. The last time I bought carpet (about 10 years ago) I paid about $4 per sq ft. You can get something. Hi, according to HomeAdvisor, carpet repair costs can range from $ to $, or approximately $ per square foot. That price can vary depending on the. Prices range from $2 a square foot for the most inexpensive carpeting, including some self-adhesive carpet tiles, to as much as $ a square yard for high-end. With carpet starting at just $ per square foot and a huge selection of stain-resistant carpets, you can find the perfect value for your space while staying. The average cost for carpet installation in the United States is typically in the range of $3 to $6 per square foot. Here's a rough estimate for. Most carpet materials cost between $2 and $7 per square foot, although wool carpet can be even more expensive. Olefin/Polypropylene Carpet. One of the most. The average carpet installation cost is $2 - $9 per sq ft. · Room-specific costs vary: bedrooms ($1, to $6,), living rooms ($1, to $7,), basements ($. Carpet Prices - Padding & Installation ; 9x12, $ ; 10x12, $ ; 12x12, $1, Take my Carpet Foot-Traffic Test to learn your Foot Traffic Score. $ cents per square foot is the same price as $ per square yard. The. Prices range from $2 a square foot for the most inexpensive carpeting, including some self-adhesive carpet tiles, to as much as $ a square yard for high-end. When measuring for your new carpet, a carpet calculator is a helpful tool both for determining your needed square feet and estimating what the material will. According to HomeAdvisor, the national average labor costs for carpet installation is “$ to $1 per square foot.” Combine that with the cost of your carpet. Nylon carpets are easy to clean and durable carpets. Based on our observations, the average cost of new carpet for nylon ranges from $2 – $5 per square foot. Wondering what people in your area charge for a carpet removal and install fr a 18 foot boat average of 65 hours, that's an additional cost of $ At approximately $ to $11 per square foot to install carpet in your house, the square footage will be the most significant determinant of your carpeting. How much does it cost to install carpet? According to HomeAdvisor, labor costs and materials can range from $ per square foot to $11 for carpet installation. Selecting the carpet - carpeting can cost as little as $2 per square foot Carpet padding should cost on average about $ to $ square foot. For. Most carpet comes in a standard width of 12 feet. With this being the case, if you have a room that measures only 8 feet wide by 8 feet long, the raw square. SO for Home Depot carpet runs between $1-$6 a square foot and the padding is $ $ a square foot. img. Home Improvement Expert: ChadT Professional installation ranges from $–18 per square foot, including labor and materials. (Note: Carpeting is often sold by the square yard. Be sure to do.

Sephora Credit Card Login

Sign In · Frequently Asked Questions · All Help Topics · Can't Find What You're Looking For? · Contact Us. The Sephora Visa Signature card offers all the benefits of the Sephora Visa card as well as exclusive access to the following: Visa concierge: Assists with. Shopping at Sephora just got even better. Apply for the Sephora Credit Card now and earn 25% off your first purchase today! Enjoy access to premium rewards, valuable benefits and special experiences with the ease and security of your Visa Signature Credit card. Sign in. Appearance. Search. Home · Apps · Finance · Sephora Credit Card Manage Sephora Visa® Credit Card. Website: ridinglawnmower.site Disclaimer: WebCatalog is. sounds like someone's jealous that we all got approved for the Sephora Credit Card textnow app keeps denying me login or even to. Welcome! Sign In to Your Account. Username. 2X Beauty Insider points per $1 spent at Sephora. cardmember benefits. image of sephora credit card and sephora visa credit card access to exclusive rewards. Welcome to Account Center. Sign in to manage your account. New here? Visit navigation to register for online access or to use EasyPay. Sign In · Frequently Asked Questions · All Help Topics · Can't Find What You're Looking For? · Contact Us. The Sephora Visa Signature card offers all the benefits of the Sephora Visa card as well as exclusive access to the following: Visa concierge: Assists with. Shopping at Sephora just got even better. Apply for the Sephora Credit Card now and earn 25% off your first purchase today! Enjoy access to premium rewards, valuable benefits and special experiences with the ease and security of your Visa Signature Credit card. Sign in. Appearance. Search. Home · Apps · Finance · Sephora Credit Card Manage Sephora Visa® Credit Card. Website: ridinglawnmower.site Disclaimer: WebCatalog is. sounds like someone's jealous that we all got approved for the Sephora Credit Card textnow app keeps denying me login or even to. Welcome! Sign In to Your Account. Username. 2X Beauty Insider points per $1 spent at Sephora. cardmember benefits. image of sephora credit card and sephora visa credit card access to exclusive rewards. Welcome to Account Center. Sign in to manage your account. New here? Visit navigation to register for online access or to use EasyPay.

Welcome, Select Your Card · Sephora Visa® Credit Card · Sephora Credit Card.

Find your credit card account quickly to sign in. Then, you can manage your account online or learn more about your card's benefits today. Welcome to Account Center. Sign in to manage your account. New here? Visit navigation to register for online access or to use EasyPay. If there's a grey strip covering the card and access numbers, gently scratch it off with the help of a coin. 2. In-Store Balance Check. If you are at a Sephora. Earn 5x total points on travel purchased through Chase Travel SM, excluding hotel purchases that qualify for the $50 Annual Chase Travel Hotel Credit. Welcome! Sign In to Your Account Username Password Show Remember Me Sign In Forgot Username / Password? Register Now. Sign in to manage your account. New here? Visit navigation to register for online access or to use EasyPay. Sign In. Forever 21 Credit Card. FOREVER REWARDED. No cash or ATM access. The ridinglawnmower.site Visa eGift Card can be redeemed online or in stores everywhere contactless Visa debit cards are accepted in the U.S. No. Current cardholders sign in to your account or use EasyPay in navigation to You can earn 8% back in savings by combining Credit Card Rewards and Beauty. this for you. Please call: (Sephora Visa) / (Sephora Visa Signature) / (Sephora Credit Card). The Sephora Visa Signature card offers all the benefits of the Sephora Visa card as well as exclusive access to the following: Visa concierge: Assists with. You can apply online at ridinglawnmower.site, via the Sephora App, or at your nearest Sephora store. Regardless of how you apply, once approved you will. Live Customer Care hours may vary on holidays. Access automated customer care days a year, 24 hours a day, 7 days a week. Sephora Visa® Credit Card. 24 x 7 x Live Customer Care hours may vary on holidays. Access automated customer care days a year, 24 hours a day, 7 days. Honestly, the Sephora CC is crap. The website is the most awful interface I've ever used. I've tried a 1, times to login with the account. You can access the Sephora Credit Card login page here. How do people rate the customer service and user experience of Sephora Credit Card? Overall, Sephora. Sign Infor FREE Shipping. 0 · Home Shop The remaining balance can be paid by credit or debit card, Gift Cards, eGift. Extra Benefits: Sephora credit cards may offer additional benefits, such as extended return periods, access to beauty classes or workshops, or. You can access the Sephora Visa Credit Card login page here. How do people rate the customer service and user experience of Sephora Visa Credit Card? We. sounds like someone's jealous that we all got approved for the Sephora Credit Card textnow app keeps denying me login or even to. Pay your Comenity Credit Card bill — no online account necessary. Credit This site gives access to services offered by Comenity Bank, which is part of Bread.

Stimulus For Home Buyers

A homebuyer credit of up to $6, (up to $3, for a married individual filing separately) is available to homebuyers who have lived in their current homes. Concord's CDBG and HOME Funding Priorities. Downpayment Assistance Program. Housing Rehabilitation Assistance Programs. Resources for General Contractors. Homebuyers who purchased a home in , or may be able to take advantage of the first-time homebuyer credit. Wesleyan provides first mortgage assistance on residential properties for the purpose of supporting and encouraging faculty and staff to secure home ownership. Learn about government programs that make it easier to buy a home, including loans, mortgage assistance, and vouchers for first-time home buyers. The Homeowner Assistance Fund (HAF) is a federal program to help homeowners remain in their homes. A large majority of states are running this program. Total household income of up to 80% of Area Median Income. Must complete homebuyer education course, minimum 6 hours. Must be mortgage ready in 24 months. The purpose of the Homeowner Assistance Fund (HAF) is to prevent mortgage delinquencies and defaults, foreclosures, loss of utilities or home energy services. The United States Department of Housing and Urban Development (HUD) also provides grants to first time home buyers. Such grant scheme are often modified or even. A homebuyer credit of up to $6, (up to $3, for a married individual filing separately) is available to homebuyers who have lived in their current homes. Concord's CDBG and HOME Funding Priorities. Downpayment Assistance Program. Housing Rehabilitation Assistance Programs. Resources for General Contractors. Homebuyers who purchased a home in , or may be able to take advantage of the first-time homebuyer credit. Wesleyan provides first mortgage assistance on residential properties for the purpose of supporting and encouraging faculty and staff to secure home ownership. Learn about government programs that make it easier to buy a home, including loans, mortgage assistance, and vouchers for first-time home buyers. The Homeowner Assistance Fund (HAF) is a federal program to help homeowners remain in their homes. A large majority of states are running this program. Total household income of up to 80% of Area Median Income. Must complete homebuyer education course, minimum 6 hours. Must be mortgage ready in 24 months. The purpose of the Homeowner Assistance Fund (HAF) is to prevent mortgage delinquencies and defaults, foreclosures, loss of utilities or home energy services. The United States Department of Housing and Urban Development (HUD) also provides grants to first time home buyers. Such grant scheme are often modified or even.

The CalHome Program Provides grants to local public agencies and nonprofit corporations for first-time homebuyer and housing rehabilitation assistance. That funding will help Montana homeowners, and homeowners across the country, remain in their homes. The Montana Homeowner Assistance Fund includes $50 million. The Neighborhood Homes Investment Act will introduce a new federal tax credit to help fund "the development and renovation of family housing. The Worker, Homeownership, and Business Assistance Act of extended and expanded the tax credit for first time homebuyers that had been created in The. Also known as the Section Home Repair program, this provides loans to very-low-income homeowners to repair, improve or modernize their homes or grants to. FHA loans. The Federal Housing Administration (FHA) manages the FHA loan program. It helps homebuyers by insuring their loans so lenders can offer lower. Government stimulus investments could help support infrastructure, and How are first-time home buyers distinctly tracked in your country? In early. It provides up to $80, in assistance to eligible homeowners to help with: Past-due mortgage payments; Missed property taxes; Partial claims and loan. Since the home purchase process can be costly and complex, THDA requires homebuyer education for all Great Start, Great vantage, and stimulus Mortgage Loan. This program provides loans to very-low-income homeowners to repair, improve or modernize their homes or grants to elderly very-low-income homeowners to. Effective January 1, first-time home buyers will get a financial break on the purchase of their new home that is double the previous amount. First time home. Need help buying a home? You may qualify for one of these programs. Tennessee Housing Development Agency (THDA) - THDA maintains a list of trainers approved to. Housing and Community Development works to assist with home ownership (education, counseling, underwriting, etc.). This is to ensure strong housing stability. There are several drafts of bills to provide a new First Time Homebuyer Credit and/or a First-Time Home Buyer Grant. The information is on this page, but is not. The purpose of HAF was to prevent mortgage delinquencies and defaults, foreclosures, loss of utilities or home energy services, and displacement of homeowners. Stimulus Loan Program Overview. In recent federal economic stimulus efforts, incentives to purchase homes through tax credits were provided to first time. Last year's tax stimulus package contained a joke of a tax credit for first-time home buyers. Why a joke? Because the credit was not really a tax. The Augusta Housing & Community Development Department (AHCDD) offers financial assistance to low to moderate-income, first-time homebuyers through the. The repayment period begins with the second taxable year following the year of qualifying home purchase. There are exceptions that may require you to accelerate. The Department of Housing offers a number of programs to assist current homeowners in making repairs to their homes, and contracts with housing counseling.

What Do Mortgage Lenders Look At On Your Credit Report

Lenders look for the history of loans taken by you and also the way the loans were ridinglawnmower.site also look for current loans you have taken from. What else do mortgage lenders use to determine your terms? In addition to your credit score, mortgage lenders consider several other factors when reviewing. Mortgage lenders will use Experian FICO 2, TransUnion FICO 4, and Equifax FICO 5. These are commonly called your mortgage scores and they will. Not matter if you apply for a credit card or a personal loan, your lender will have a look at your credit report at some point during your application. Why? Most lenders use FICO® scores from all three credit bureaus when evaluating your loan application. Your score will likely be different for each credit bureau. Of course, there are always exceptions, and there are lenders out there who don't actually look at credit scores or will even loan funds to people with a shaky. Mortgage companies and other lending institutions may review any data contained within your credit reports. Data from the past 24 months is the most. If you pay your bills on time and how leveraged you are (credit utilization). Also debt to income 35% or lower as an approximate. Most mortgage lenders use the FICO Credit Scores 2, 4, or 5 when assessing applicants. Mortgage lenders who offer conventional mortgages are required to use a. Lenders look for the history of loans taken by you and also the way the loans were ridinglawnmower.site also look for current loans you have taken from. What else do mortgage lenders use to determine your terms? In addition to your credit score, mortgage lenders consider several other factors when reviewing. Mortgage lenders will use Experian FICO 2, TransUnion FICO 4, and Equifax FICO 5. These are commonly called your mortgage scores and they will. Not matter if you apply for a credit card or a personal loan, your lender will have a look at your credit report at some point during your application. Why? Most lenders use FICO® scores from all three credit bureaus when evaluating your loan application. Your score will likely be different for each credit bureau. Of course, there are always exceptions, and there are lenders out there who don't actually look at credit scores or will even loan funds to people with a shaky. Mortgage companies and other lending institutions may review any data contained within your credit reports. Data from the past 24 months is the most. If you pay your bills on time and how leveraged you are (credit utilization). Also debt to income 35% or lower as an approximate. Most mortgage lenders use the FICO Credit Scores 2, 4, or 5 when assessing applicants. Mortgage lenders who offer conventional mortgages are required to use a.

Underwriters then analyze the risk of offering you a loan based on the information in your application, credit history, and the property's value. Looking to buy. Lenders use your credit report to determine if there's any risk associated with lending you money. This will help them decide the terms of a loan, including the. Payment history accounts for 35% of a borrower's FICO score and can be the most important factor for lenders. · Missed payments and large amounts of outstanding. Your full credit report extends beyond your credit score; it documents all your credit activity, the status of current credit cards and loans, history of. Most lenders use FICO® scores from all three credit bureaus when evaluating your loan application. Your score will likely be different for each credit bureau. Data from the past 24 months is the most important information that mortgage lenders look at. However, they could look at derogatory information, like. Typically, though, a mortgage will remain on your report for up to 10 years after you pay it off. There was an error made somewhere along the way. To err is. Tri-merge credit reports help mortgage lenders determine the size and type of your loan. Learn more about the role this report plays in your application. Payment History: Lenders will also check your payments on other loans, credit cards, lines of credit, or any other account on your credit report. Consistent on-. The credit score is an objective measurement of your credit risk at a particular point in time. Lenders use credit scores along with a variety of other types of. As the name suggests, the middle score is the one in the middle of your three scores. For instance, if your credit report shows , , and , then is. What do mortgage lenders check? · Your income – your regular cash flow · Your credit report – they'll prefer a positive credit history · Your assets – anything. For example, let's say you're going to buy a house. When mortgage lenders review your credit history, it's likely they'll use a credit score formula tailored to. The next time you apply for a credit card, loan or mortgage, the lender will likely request access to your credit report. Information that does not appear on. Lenders will be able to see details of all your credit accounts. This includes any mortgages, credit cards, overdrafts and personal loans you might have along. When considering your financial history, mortgage lenders typically look back at the past two to three years on a bank statement. For credit history, they may. The effect of a mortgage inquiry on your credit score is small. Here's why: Your FICO® Score is typically used (credit scores rank from ) with a mortgage. The credit score serves as a risk indicator for the lender based on your credit history. Generally, the higher the score, the lower the risk. Credit bureau. Lenders look at your credit report to see what significant monthly debts you have, including collections and charge-offs. Using these figures, they calculate. Your debts and payment history with companies that have loaned you money. This includes banks, credit card companies, mortgage companies, and other lenders or.

How To Make Money When You Are Young

Affiliate marketing can be one of the best online jobs to make money as a teen because it requires no initial investment and you don't need any experience or a. TutorMe – A cool site offering on-demand tutoring, where young tutors can help others in need of academic assistance and get paid for their expertise. Chegg. There are several ways for a year-old to earn money. You could start by offering services like pet sitting, lawn mowing, or babysitting in. If you excel in a particular subject, tutoring can be a lucrative way to share your knowledge and help others. You can tutor peers, younger students, or even. Need some extra cash? Want to save for university? Sell online, become a tutor, or start your own business. Check out our tips on how to make & save money. From traditional ads to selling merchandise to memberships for your fans, there are a lot of ways to use your channel and videos to make money. YouTube. Kids with plenty of free time can take online surveys since they don't need to have any skills or experience. Teenagers as young as 13 are. Use your talents. Tailor your search for your main job and any other income streams you plan to earn to your individual talents. People who are extraordinarily. Got a Broke Teen? 10 Ways to Earn Extra Money For Young Adults · Babysitting. The tried and true classic! · Music Lesson Teacher · Lawn Mowing Business · Companion. Affiliate marketing can be one of the best online jobs to make money as a teen because it requires no initial investment and you don't need any experience or a. TutorMe – A cool site offering on-demand tutoring, where young tutors can help others in need of academic assistance and get paid for their expertise. Chegg. There are several ways for a year-old to earn money. You could start by offering services like pet sitting, lawn mowing, or babysitting in. If you excel in a particular subject, tutoring can be a lucrative way to share your knowledge and help others. You can tutor peers, younger students, or even. Need some extra cash? Want to save for university? Sell online, become a tutor, or start your own business. Check out our tips on how to make & save money. From traditional ads to selling merchandise to memberships for your fans, there are a lot of ways to use your channel and videos to make money. YouTube. Kids with plenty of free time can take online surveys since they don't need to have any skills or experience. Teenagers as young as 13 are. Use your talents. Tailor your search for your main job and any other income streams you plan to earn to your individual talents. People who are extraordinarily. Got a Broke Teen? 10 Ways to Earn Extra Money For Young Adults · Babysitting. The tried and true classic! · Music Lesson Teacher · Lawn Mowing Business · Companion.

Summer camp counselor roles provide perfect seasonal income if you like working with groups of younger kids. Sleep away and day camps across. Some of the more common types of jobs for young adults may include babysitting, pet-walking, yard work, tutoring and other ways to help people in your area. If. Step 1: Make a budget. A written budget maps out your income and expenses by showing where your money goes, month-to-month. It supports your spending and. If you look at the current real estate scenario, then it stands true that the real estate industry has made more money as compared to any other industry. Get a part time job and work with your parents to open a custodial Roth IRA for yourself. Max that out twice (2 x $ = $13,) and invest it. Regardless if you are young or a teen here is the ultimate guide to make money as a kid. At what age can you start working in the UK? What is the minimum wage? How many hours can I work? You might be old enough to start earning money and it's. No matter how young you are, plan for your retirement now. With the power of compound interest, when you start saving in your 20s, you will earn interest not. To earn money you need to learn something some skill. Teens who work also learn some great time management and communication skills. They also. By creating content on social media platforms like TikTok and YouTube, and showing they can grow their own audience, young people can open a pathway to earning. Got a Broke Teen? 10 Ways to Earn Extra Money For Young Adults · Babysitting. The tried and true classic! · Music Lesson Teacher · Lawn Mowing Business · Companion. 3. Watering Plants Another good way for a younger child to make money is to water plants for older neighbors or for people who go out of town. While they may. Do Freelance Writing – If you love to write, you can make money online. Companies are always looking for web content, and they tend to hire freelancers. 1. Make a budget. You've heard it before. Creating and sticking to a budget is one of the best ways you can save money. Making a. Try Hard To Make Money While You're Young To Avoid Regret. Make money while you're young When you're young, you have the enthusiasm to learn. You also have a. / Money as You Grow / Teens and Young Adults Compound interest is when your child earns interest on both the money they save and the interest they earn. The activities in the toolkit encourage youth to explore the connection between the choices they make, and the money needed for those choices. This informal. Learning the basics of money management helps you prepare for your future. Whether you have income from work or government benefits, learn ways to budget. 6 money moves to make in your 20s · Create a budget and stick to it · Build a good credit score · Set up an emergency fund · Start saving for retirement · Pay off. Similar to shoveling driveways, but available all year long, yard work is another good option for younger children who want to earn some extra cash while also.